From EU medical device regulation (MDR) to NMPA (chinese authority)

Background

In this article we want to reveal the spirit to register medical device in China from MDR (EU manufacturer).

The key to be successful at international registration is to know the country specific requirements and regional registration pathways.

It is first to know that most Chinese registration is based on home country approval. Manufacturer doesn’t start Chinese registration from zero, but can profit from a broad MDR (or former MDD) complex. The design history file from R&D and device master record is nearly unchanged as a basis. Depending on the product group, you could have a Chinese variant of medical device with Chinese labelling, local testing (in China) with Chinese standard and oft with Chinese clinical evaluation. The trouble and pain is how to split an EU technical document to fit structured electronic folder of Chinese technical document.

Pathway of Chinese registration

1. Legislative

European Union with 27 member states issues the law Medical Device Regulation (MDR) starting in 2017. However the individual notified bodies are assigned for product and system certification. National Medical Products Administration (NMPA) issues the regulation of medical device in China and its sub-organisation reviews and approves registration dossier.

State Council Ordinance 739 with 107 articles in 2021 by Chinese authority NMPA is equivalent to EU MDR comprising 123 articles and 17 Annexes. In China There are supporting orders e.g. stipulating registration, GMP, classification, clinical evaluation, post market surveillance and technical documentation et cetera. Besides it there are general and product specific standards and guidances.

2. Chinese agent (& EU authorised representative and Person Responsible for Regulatory Compliance)

Chinese agent is as liaison between foreign manufacturer and Chinese authority. Chinese agent has more responsibility than authorised representative in EU however less liability for product in the market. There is no role as Person Responsible for Regulatory Compliance at manufacturer required in China.

Besides the following responsibilities, Chinese agent has an most important role to submit the technical document to authority and to obtain product approval.

• Compilation of the submission dossiers

• Communication with NMPA

• Report of adverse event

• Assistance of the potential inspection by authority

• Transfer of regulatory update

3. Classification and product code

In China there is a different classification system more similar to FDA than to EU. The same is the risk-based classification of medical device. Depending on intended use you can match to right 6-digits product code which automatically has its classification (I, II and II). The higher the classification is, with more demanding is technical document to submit.

4. Product Certification only

In EU there are 3 years certification cycles for quality management system, very often in combination of MDR and ISO 13485. To register product in China, manufacturer only has to submit valid ISO 13485 certificate. In theory NMPA may make a remote or onsite overseas inspection of foreign manufacturer which is rare.

So Chinese registration is a pure product certification. Unlike in EU (MDCG 2019-13 Guidance on sampling of MDR Class IIa / Class IIb and IVDR Class B / Class C device), all manufacturers of class II and III medical device has to submit each technical document in China. For class I medical device there is only an easy filling system.

There are three types of registration mainly in China: initial-, change registration and renewal. Because the Chinese certificate is only 5 years valid, manufacturer has to renew certificate very 5 years upon no significant change (similar to article 120 of MDR in EU).

“Risk” is frequent mentioned at MDR. In China although it is rarely written at highest law of medical device, still there is a risk-based registration benefiting from clear product code for general group. Only some of high risk products need clinical trial or complex clinical evaluation.

5. Technical document

In accordance to guidance “Non-In vitro Diagnostic Device Market Authorization Table of Contents” at International Medical Device Regulators Forum (IMDRF), NMPA published in 2021 guidelines for electronic submissions with requirements aligning with international table of content (toc) for all submission format. The submission dossier in China is in structured electronic toc and in Chinese language. Derived from Annex II at MDR manufacturer has a good reference dossier to transfer to Chinese TD. However often due to Chinese requirements manufactures have to re-puzzle the contents in Chinese dossier. There are 6 main chapters (CH x) of Chinese TD.

6. Local testing and clinical evaluation report

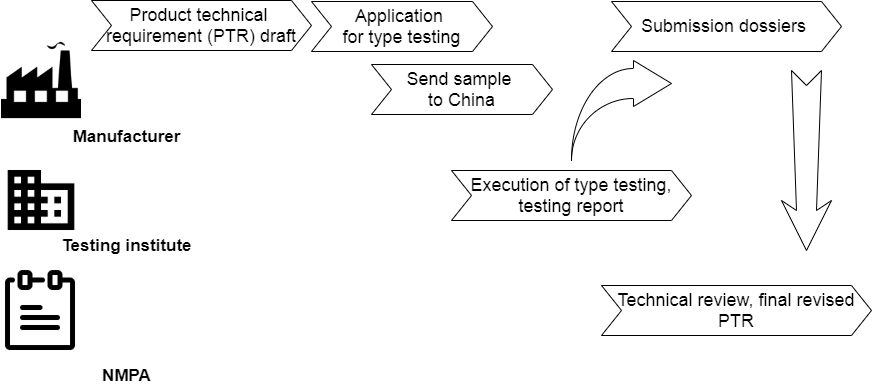

Special at Chinese registration is local testing. It is also called in-country testing or product/sample testing.

Besides preparing submission dossiers in paper at product registration, the foreign medical device must be sent to accredited testing institutes by NMPA in China after drafting “product technical requirement” (PTR).

The clinical evaluation report (CER) in China has 3 scenarios: simplified CER in table, CER based on equivalent or similar devices and Chinese clinical trial. For the second scenario, manufacturers have to compare in China approved equivalent medical device and search also Chinese literature. For the third scenario, there is a good trend that overseas clinical study is fully or partially accepted.

7. Submission and review of technical documents

The review process of medical device in EU is perhaps a sensible topic. Each NB has its own charisma.

The authority under NMPA, Chinese medical device evaluation (CMDE) proves electronic technical documentation of imported products of class II and III manufactured outside China.

In China the review time by authority is 153 working days for class 2 MD and 183 working days for class 3 MD (*20 working days are one month). The authority set every year new records to reduce review days than official needed.

8. Approval and post market surveillance

Upon product approval manufacturer should finalise Chinese labelling with certification number. Similar to Eudamed in EU, manufacturer has to upload UDI and issuance code in different Chinese database.

The post market surveillance is less complex in China than in EU (see below). For sure the workflow and deadline to report vigilance is in China way different and in rapid march in number.

Zero to positive impact of MDR on Chinese registration

EU labelling

Compared MDR annex I, chapter III (Labelling) to Chinese guidance of labelling, there are only nice to have contents on EU labelling. Manufacturers can keep a variant of Chinese labelling fitting Chinese requirement or transfer new MDR contents one to one to Chinese labelling.

Post market surveillance

This is the most challenging part at MDR underscoring patient safety. The market surveillance report in EU acts a good basis to provide new annual quality management report and periodic risk evaluation report in China. If overseas clinical trial was existing, it could assist the potential requirements of clinical trial in China. The degree of difficulty of Chinese Post market surveillance is developing and raising.

Capacity of authority

Chinese authority unlike EU notified body is from government, issues regulation and proves all imported medical device. Whenever new regulation is published, the authority has no excuse for transition or capacity. In the reality like FDA, Chinese authority strives to break record of review time of submission dossier.

Reclassification

There is a trend at MDR that some products are up-classified. Actually it has no impact on Chinese classification because in China there is own classification rule and product code system.

Change assessment

The guidance for significant change is MDCG 2020-3 Guidance on significant changes regarding the transitional provision under Article 120. Its focus is till for MDD - to MDR products. Depending on NB the notification and review of significant change in EU is diverse. It is rarely that upon significant change you have to re-submit the whole technical documents again.

There is only system of new change registration upon significant change of products or record minor change in QM system in China. No context in term of product change is between 2 markets.

MDD-MDR transition impact

Declaration of conformity

CE certificate is typical recognised as home country evidence for EU manufacturer in China. Independent of classification and transition of MDR, at time of submission to Chinese authority, the declaration of conformity at EU manufacturer should be valid.

EU 2023/607

So far there is no notification from Chinese authority whether they accept the agreement of notified body with manufacturer to accept MDD certificate valid upon any conditions. However it is expected that the transition of MDD products will be accepted in China.

In the case of MDD certificate with inactive (obsolete product) which is valid till e.g. Dec, 2018, manufacturer can outsource production in China. There are 2 options:

1. For in China approved product with no MDR future, manufacturer could make an accelerated “local to transfer” registration and have an own entity to produce medical device after approval (additional Chinese GMP needed).

2. For never in China approved product with no MDR future, manufacturer could start a new registration and outsource third party in China to produce medical device quasi outsourcing Chinese production.

For both options at the end of approval, the product is made in China and could profit a lot as local product at tender.

Outlook

Either you have technical document compliant to MDD or MDR, contact us e.g. in term of on-demand workshop to have in-depth gap analysis.

Or you want to have a solid training of Chinese registration, visit our 1 year online university with free